Input 2021.01.08 15:10

According to the financial investment industry on the 8th, Samsung Electronics’ market cap was 23.82% in the securities market as of the previous day’s KOSPI index (3031.68). Samsung Electronics Woo (005935)Market cap accounts for 2.94%. The total market cap of Samsung Electronics is 26.76%. On this day, Samsung Electronics recorded 90,000 won during the market, exceeding 2:30 pm. It’s the best price ever.

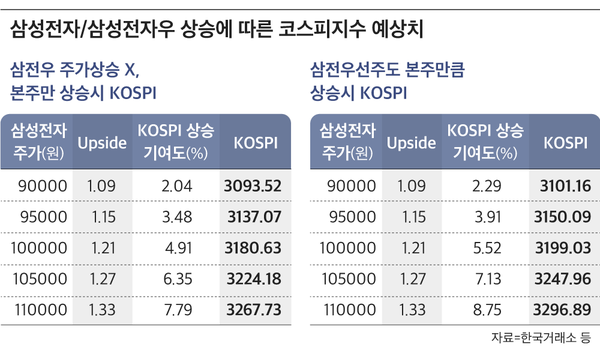

In the same way, the KOSPI index is 3137.07 when Samsung Electronics is 95,000 won, and 3180.63 when it is ‘100,000 electrons’. When the stock price is 105,000 won and 110,000 won, it is 3224.18 and 3267.73, respectively. If Samsung Electronics reaches 110,000 won, the contribution to the KOSPI index reaches 7.79%.

If Samsung Electronics’ likelihood rises as well as Samsung Electronics’ rising rate, the KOSPI index rises even more. If the preferred stock also rises when Samsung Electronics is at 90,000 won, the KOSPI can rise to 3101.16. When it was 95,000 won, it was 3150.09 and when it was 100,000 won, it recorded 3199.03. At 105,000 won and 110,000 won, you can expect up to 3247.96 and 3296.89, respectively.

The financial investment industry suggested a target price of up to 110,000 won for Samsung Electronics as of the day. Hana Financial Investment raised the target price to 110,000 won, and DS Investment & Securities offered 104,000 won. Ebest Investment & Securities and Kiwoom Investment & Securities set target prices of 100,000 won. Other securities companies have also raised their target price to the 95,000 won line.

Samsung Electronics, which has been reborn as a national stock among individuals, has hesitated to the 40,000 won line in the aftermath of the novel coronavirus (Corona 19) in March of last year, and has since risen steadily. From last month to the 7th, Samsung Electronics’ growth rate recorded 22.27%.

Stock prices and investors believe that Samsung Electronics has more upside potential due to the recent breakthrough of the KOSPI index and expectations for a’semiconductor super cycle (long-term boom)’. In the second half of last year, the stock price of Samsung Electronics, which remained at the 50,000~60,000 won range, has recently risen to 90,000 won amid expectations for semiconductors.

Samsung Electronics announced that last year’s annual sales were 236 trillion won and operating profit of 35.95 trillion won. Compared to 2019, sales increased by 2.54% and operating profit increased by 29.46%. In particular, Samsung Electronics’ DS division’s operating profit last year is estimated to be about 19 trillion won. Despite the bad news of Corona 19, the demand for semiconductors has increased significantly, which means it has achieved good results.

Kim Yang-jae, a researcher at KTB Investment & Securities, said, “This year’s semiconductor-focused performance will improve.” “In the memory division, further performance improvement will be possible as DRAM prices rebound faster.”

Samsung Electronics’ electrical equipment business is also drawing attention. Hana Financial Investment, which offered a target price of KRW 110,000, explained that “Harman, a subsidiary in charge of the electronic equipment business, has the highest value.”