That is why the KOSPI 3000 era is more special in the Korean stock market. 1000·2000·3000, How will the situation in the Korean stock market and the current situation be different and the same when the KOSPI index exceeded the main node? I asked stock market experts.

|

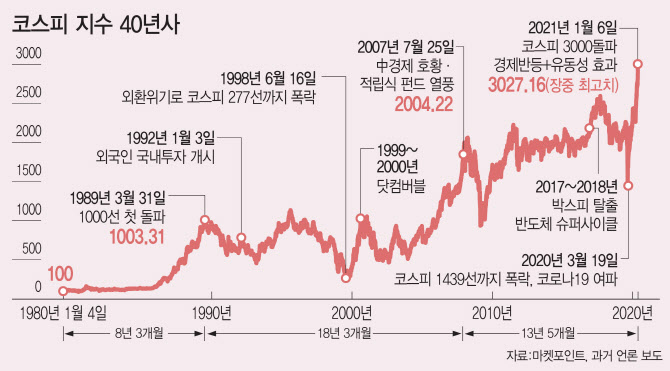

◇ 3 Low boom, dot-com bubble, Corona 19… Curved Korean stock market history

The KOSPI Index, which was launched at the 122nd Oath in 1983, surpassed the first 1,000 point high in 1989 with a’three low boom’ of low interest rates, low oil prices, and low dollars. At the time, the brokerage hall was so crowded with investors that an announcement to find a missing child was broadcast. Right after the presidential election victory in 1987, the Roh Tae-woo administration also announced a “national democratic development and dissemination plan” for the people of the middle class and below. Foreign investors have been in the market since 1992, so the stock market has risen purely by personal strength.

However, the 1,000 points achieved in six years collapsed in just five days. This is because the United States faced’Black Monday’ and the pressure on the appreciation of the won rose. The word “residents (株災民)” came up because people with can accounts are similar to victims. Afterwards, the KOSPI index recovered 1000 points from the dot-com bubble, but the problem is that the dot-com bubble, which had been swollen in anticipation of the new millennium, went out without appearance as the new millennium came. The KOSPI index, which started at 1000 points in 2000, was cut in half to 500 points at the end of that year.

The KOSPI 2000 era will take place in 2007 thanks to the rapid growth of the Chinese economy and the craze for funded funds. That year, the growth rate of China’s gross domestic product (GDP) recorded a whopping 14.2% and peaked. As a result, the Korean export economy benefited and the KOSPI rose. In addition, the craze for investing in accumulated funds has also added. Mirae Asset’s’Insight Fund’ attracted 3 trillion won like a black hole in 15 days despite a 2.5% commission. However, with the global financial crisis coming, the KOSPI index plunged to 892 points in October 2008, hurting investors’ hearts.

It was 2021 that the KOSPI index, which had been trapped in the box for a long time, broke the trend and reached the 3000 line. After Corona 19, it plunged to the 1439 line, but afterwards, central banks, including the US Federal Reserve System (Fed), supplied large-scale liquidity and the stock market stood again like a pit. In particular, in the case of Korea, individual investors accept both foreign and institutional thrown sales and firmly support the market. This was nicknamed’Donghak Ant Movement’.

Like the past, another 3000 era… What is the significance?

‘This time It’s different’. Everyone is talking about the KOSPI 3000 line. The fact that the interest rate is so low, and that individual investors in such a short period of time have flowed into the stock market on a large scale cannot be found.

Experts agree on some points. In the early 2000s, Nam-woo Lee, a visiting professor at Yonsei University, who served as the head of the research center at the age of 34, said, “In the 80s, the stock market rose with personal strength, which is similar to today, but foreigners were unable to participate in the Korean stock market. It is difficult to compare because both the growth rate and the interest rate were high. Even during the dot-com bubble, interest rates were high.”

However, there are many opinions that it is similar to the past in a large frame. Economist Lee Jong-woo said, “When the KOSPI broke through the Mardi index such as 1,000, 2000, and today, it was a period when liquidity created a bubble.” “At the time, there were many reasons for the stock price to rise, but it fell shortly after a few years. Only later, I used to recover the node index again.”

Then, what is the significance of the KOSPI 3000? Experts expect that the Korean stock market can escape from the ‘Cheon Soo-answer stock market’.

Kim Hak-gyun, head of the Research Center, said, “In the past, Korean stock markets had the stigma of being a’thousand-spoken stock market,’ where foreigners climbed and sold on par. Now, the inflow rate and scale of individual investors are incomparable to the past. Considering that, there is still room to enter the stock market, and as long as there is a structural problem of low interest rates, the influx of individual investors will lead to the inflow of the stock market, and it may relieve volatility in the future.