A 38-year-old office worker, Yoo Ji-soo, joined a paid investment information center while watching the stocks surge in March. They pay 200,000 won per month, receive corporate analysis and investment information, and earn more than 500,000 won per month. Yoo said, “Some people earn half-year membership fees in a month in this room.”

|

The temperature has dropped below -10 degrees Celsius, but the whole country is hot with stock investment. Even if only two people get together, we don’t miss out on stocks. On the way to commute, you can easily find people who watch YouTube channels, where stock information is posted.

Since the KOSPI market settled at the 2500 line in November of last year, it rose daily and touched the 3000 line on this day. There are also reactions with worries about whether it has already risen enough, but it is emerging as the only investment destination with low interest rates and real estate investment blocked, and individuals are drawing attention. This interest is also confirmed by liquidity.

Ants increasing investment… 69 trillion of deposits, a record high

According to the Financial Investment Association on the 6th, the investor’s deposit, which is the waiting fund for stock investment, as of the 5th, recorded 69,4409 billion won. This is the highest ever since it was counted in 1998. An increase of 1,153.6 billion won from the previous day.

More and more people are investing by dragging debt. As of the same day, credit transaction loans turned to an increase in one day, recording 19,6241 billion won, an increase of 2718 billion won from the previous trading day. Considering that credit transaction loans at the end of last year were only 9,2133 billion won, it has more than doubled in one year.

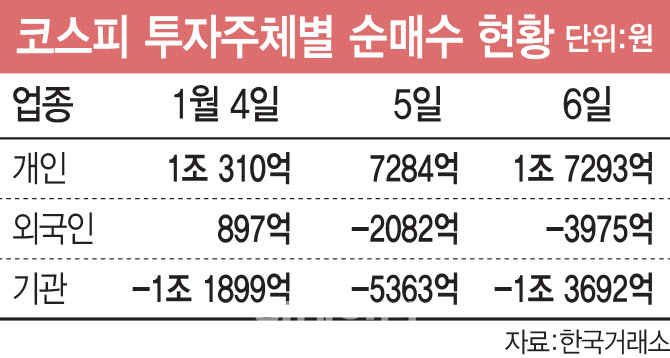

These funds are flowing directly into the stock market. Individuals who net bought 1 trillion won in the KOSPI on the first day of the new year recorded 7284 billion won on the 5th and 1.7293 trillion won on the 6th. For three days, only individuals bought from KOSPI amounted to KRW 3.4887 trillion. Even though foreigners and institutions are selling it, individual investors increased their investments, and on this day, the KOSPI rose to 3027.16 at one time during the day, rewriting the intraday high.

Lee Kyung-min, a researcher at Daishin Securities, said, “Last year, individuals only bought 47 trillion won in the KOSPI market, of which 81% are large-cap stocks.” “ He added, “Even though individual investors come in too quickly and the intensity of their purchases may weaken, if they make an uptrend again, we will often see large stocks moving 10% a day.”

Experts “Start, not the end of the 3000 line… Buying Opportunity”

On this day, the KOSPI index closed at 2968.21, down 0.75% and 22.36 points from the previous trading day. It looks like he is taking a break from the rising fatigue that continues day after day. However, investment experts judged that the 3,000 breakthrough was’the beginning, not the end’. He saw that there was more room for upside.

Researcher Lee Kyung-min said, “If you take a break after the past nine consecutive weeks, a strong second uptrend has developed.” “If overshooting becomes stronger without short-term adjustment, the trend reversed. Currently, Kospi has to rest to go further.”

At the same time, I thought that taking a break should be considered an opportunity. Lee Dong-ho, a researcher at Leading Investment & Securities, said, “In the case of Corona 19, there is still a high probability of easing over time and economic indicators will continue to recover.” There is a high probability of controlling. Considering that liquidity can also be abundant for a considerable period of time, it is highly necessary to use this as an opportunity to buy when an adjustment occurs.”

Kiwoom Securities predicts that the stock market will continue to change by industry and theme rather than by index. Seo Sang-young, a researcher at Kiwoom Securities, said, “The second week of January will focus on pharmaceutical, bio and IT materials, equipment and parts industries, the third week of green theme-related stocks, and the fourth week of large-cap stocks.” Predicted.