◆ 2021 New Year’s Rebuild Korea Stock Market ③ ◆

|

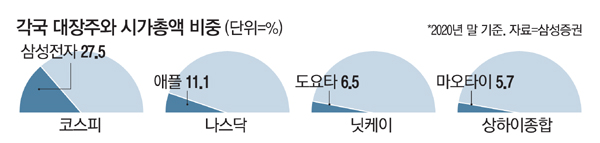

With the KOSPI surpassing 3000 at one time during the week, experts predicted that electric vehicles, rechargeable batteries, semiconductors, and bio industries will become the representative industries that will lead the Korean stock market for the next 10 years. At the same time, Samsung Electronics emphasized that in order to escape the structure that is vulnerable to market volatility, as Samsung Electronics accounts for more than a quarter of the total KOSPI, second and third Samsung Electronics should come out.

On the 6th, a survey of major domestic securities companies such as Samsung, NH, Shinhan, Hi, and Korea Investment & Securities surveyed the industries that will lead the Korean stock market for the next 10 years. In addition, △refining, △chemical, and △platform are also predicted as industries that will lead the Korean stock market. Representative items include Samsung Electronics, Samsung SDI, LG Chem, Kakao, Hyundai Motors, LG Household & Health Care, SK Hynix, Samsung SDS, POSCO, Hyundai Mobis, and Hyundai Glovis.

NH Investment & Securities chose’electric vehicles’ as a promising sector. Oh Tae-dong, head of the NH Investment & Securities Research Center, explained, “If the administration of Joe Biden, who puts an eco-friendly policy at the fore in the US, will accelerate the transition from internal combustion locomotives to electric vehicles.

Some pointed out that in order to settle the KOSPI 3000 era, the dependence on Samsung Electronics should be reduced. The share of Samsung Electronics (including preferred stocks) in the stock market exceeds one-quarter as of the end of last year. This proportion is increasing every year, and the gap between first-class and second-class stocks is high compared to major global stock markets. As of the 30th of last month, Samsung Electronics accounted for 27.5% of the total market capitalization of KOSPI. Considering that the KOSPI on the 30th of last month was 2873.47, the index at the end of 2020 excluding Samsung Electronics was only 2084.03. The gap between the market cap of No. 1 and No. 2 in the Korean stock market is quite large compared to overseas markets. SK Hynix, which ranked second as of the end of last year, accounts for 4.4% of the total market cap, which is more than 20 percentage points from Samsung Electronics.

On the other hand, Apple, the No. 1 item on the NASDAQ exchange in the US, accounted for only 11.1% as of the end of last year. The gap in market capitalization with Microsoft, the second place, is only 3 percentage points. In China and Japan, the trend toward first-class stocks is less than that of domestic stocks. In the case of Toyota Motor Company, the number one company in the Nikkei 225 Index, the proportion was only 6.5% as of the end of last year. As of the end of last year, the proportion of Guizhou Maotai in the Shanghai Composite Index was 5.7%, which is not much different from China’s Industrial and Commercial Bank of China (4.1%).

[김정범 기자][ⓒ 매일경제 & mk.co.kr, 무단전재 및 재배포 금지]

Copyright ⓒ MBN (daily broadcasting) Unauthorized reproduction and redistribution prohibited

- Popular Videos

- Attention