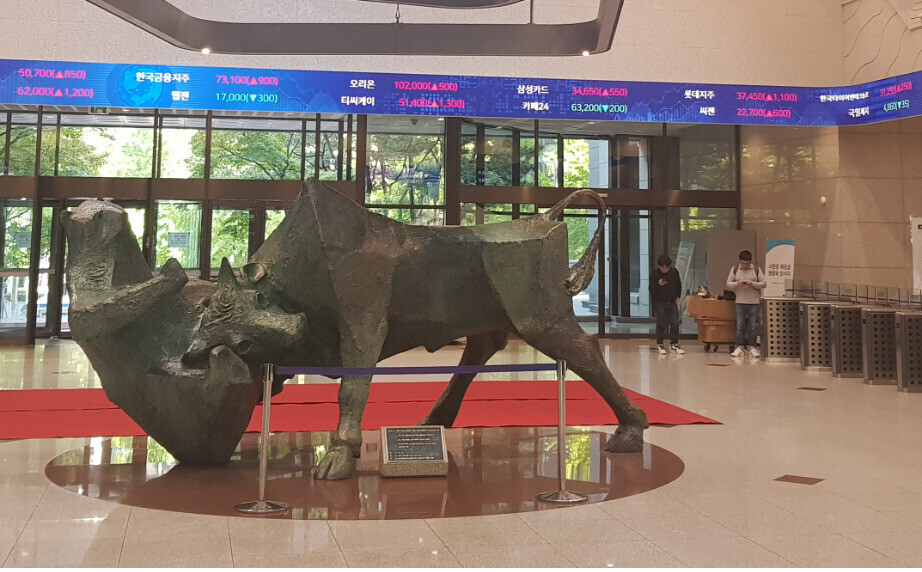

material photo” alt=”Lobby on the 1st floor of Korea Exchange in Yeouido, Seoul.

material photo” alt=”Lobby on the 1st floor of Korea Exchange in Yeouido, Seoul. Lobby on the 1st floor of Korea Exchange in Yeouido, Seoul. <한겨레> Base photo

On the 30th, the last trading day of the stock market this year, KOSPI closed brilliantly with a record high for four consecutive days. The KOSDAQ market also ended in strength. On this day, the KOSPI index rose 52.96 (1.88%) to 2873.47. Not only is it the best of the year, it is also the highest in history. On this day, the KOSPI started at 2820.36, down 0.15 (0.01%), but soon turned to the upside, increasing the range of the rise. During the week, it climbed to 2878.21. A pair of foreigners and institutional investors pushed up the index. Individuals were net selling. ‘KOSPI Daejangju’ Samsung Electronics finished at 81,000 won, an increase of 2700 won (3.45%) from the previous day, exceeding the 80,000 won level for the first time. The intraday record exceeded 80,000 won on the 28th (80,100 won). KOSPI fell to 1457.64, the lowest point of the year on March 19 immediately after the Corona 19 incident, and then escaped from a sharp decline thanks to the buying trend of individual investors, and in November, it continued to break a record high. The closing date index is 30.75% higher than the end of last year (2197.67). The KOSDAQ index was 968.42, up 11.01 (1.15%) from the previous day. It is the highest point of the year. On this day, the index opened to 957.38, down 0.03 (0.00%), and soon reversed, crossing the 970 line (971.04) during the day. In the KOSDAQ market, individual net purchases and foreigners and institutions recorded net sales. Compared to the end of last year (669.83), it rose by 44.58%. The KOSDAQ index fell to 428.35 on March 19th. On this day, the won-dollar exchange rate in the Seoul foreign exchange market fell 5.8 won to 1086.3 won. The exchange rate decreased by 0.4 won to 1091.7 won per dollar, increasing the decline. As concerns over US economic stimulus measures and’no-deal Brexit’ (UK’s withdrawal from the EU) were resolved, the sentiment of preference for risky assets such as currencies in emerging markets continued. The fact that export companies’ Nego (selling dollars) volume is still coming out is also a factor in the decline in the exchange rate. The exchange rate on this day is 70.1 won lower than the end of last year (1156.4 won). This is an annual appreciation of about 6% (the exchange rate decline). The exchange rate soared to 1285.7 won per dollar on March 19 after recording 1158.1 won on January 2, the first trading day of this year, and then gradually declined. On December 2nd, it closed at 1100.8 won and reached the lowest level in two years and six months since June 15, 2018 (1097.7). On the 3rd, it fell below 1,100 won (1097.0), and on the 4th it was the lowest point of the year (1082.1 won). By Kim Young-bae, staff reporter [email protected]