Input 2020-12-29 13:48 | Revision 2020-12-29 14:06

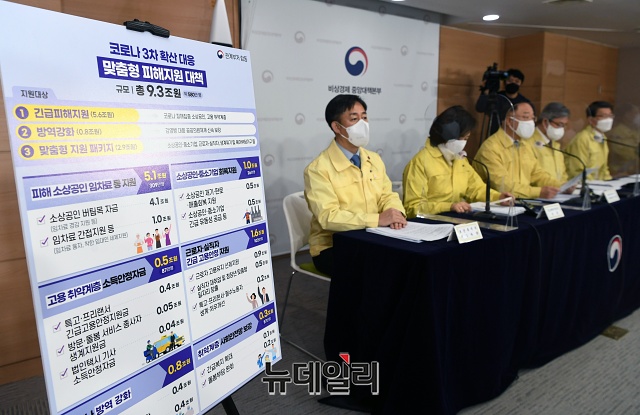

▲ Deputy Prime Minister Hong Nam-ki is announcing’customized damage support measures in response to the 3rd spread of Corona 19′ ⓒYonhap News

A plan to support the third disaster support fund worth 9 trillion won for corona 19 damage support has been confirmed.

Disaster subsidies are eligible for 5.8 million small business owners and vulnerable to employment, and payments will begin on January 11 next year.

On the 29th, the government held a’Emergency Economy Central Countermeasure Headquarters Meeting’ presided by Deputy Prime Minister Hong Nam-ki at the Government Complex in Seoul and announced customized damage support measures.

The scale of support for this measure is 9.3 trillion won, which is the fourth additional supplement. 7article8000Billion won It is actually the 5th supplementary scale.

This disaster subsidy is △5.5 trillion won for emergency damage support for small business owners and the underprivileged. △800 billion won in strengthening the prevention of Corona 19 △2.900 trillion won will be invested in each customized support package.

Of these, KRW 7.700 trillion is provided in cash and in kind, and KRW 1.6 trillion is provided through loans.

First of all, 500,000 to 3 million won in cash will be paid to 2.8 million small businessmen and 870,000 underprivileged workers, such as special type workers, who were hit by the re-proliferation of Corona 19.

Small business owners whose sales are suspended or restricted due to social distancing measures or their sales decline will receive a maximum of 3 million won’small business owner support fund’.

A common KRW 1 million is paid to 2.8 million small business owners, and 2 million KRW and 1 million KRW, respectively, are additionally paid in the name of reducing fixed costs such as rent, depending on the type of business that is prohibited from gathering and restricted from gathering.

Businesses that are prohibited from collectively receiving 3 million won include indoor sports facilities such as academies, gyms, karaoke rooms, standing performance halls, ski resorts and sledding centers, direct sales promotion halls and entertainment pubs, Danran pubs, Gamseong pubs, Hunting Pocha, and Collate, etc. It is a business type and costs 700 billion won for about 238,000 people.

The group-restricted businesses that receive 2 million won are 11 businesses, including restaurants and cafes, beauty and beauty salons, PC cafes, game rooms and multi-rooms, study cafes, movie theaters, amusement parks, large supermarkets and department stores, and lodging.

In the prohibited and restricted businesses, even if sales do not decrease from last year and increase or remain at the current level, support is now paid, and 1.6 trillion won is paid to a total of 810,000 people.

In addition, although it is not a group prohibited or restricted business, a total of 1.58 trillion won will be paid to 1 million won each for 1.752,000 small businesses in general industries with annual sales of 400 million won or less, whose sales declined from the previous year.

Small businesses related to winter sports facilities, such as ski resorts, are also paid 3 million won, the same as those prohibited for gathering, and are eligible for payment to restaurants, convenience stores, sporting goods stores and nearby rental stores.

However, 2 million won will be delivered to small accommodation facilities that meet the requirements for small business owners.

Emergency employment security subsidies of up to 1 million won have been set for special advisors and freelancers such as caddy, study guide instructor, and truck driver whose income has decreased due to Corona 19.

At this time, 500,000 won is paid to 650,000 people who received the 1st and 2nd emergency employment stabilization support fund, and 1 million won is paid to 50,000 new applicants.

In addition, a living subsidy of 500,000 won is provided to 90,000 people who are engaged in visiting and care services by spending 90 billion won, and an income stabilization fund of 500,000 won is also provided to 80,000 corporate taxi drivers.

The’good lessor’s tax credit rate, which voluntarily cuts the rent, expands from 50% to 70%.If a lessor who satisfies the condition of a total income of 100 million won or less reduces the rent, 70% of the cut is reduced from income and corporate tax.

For small business owners, the payment deadline for electricity and gas bills for January to March of next year is postponed for three months, and installment payments are allowed until September of next year.

Press releases and article reports [email protected]

[자유민주·시장경제의 파수꾼 – 뉴데일리 newdaily.co.kr]

Copyrights ⓒ 2005 New Daily News-Unauthorized reproduction, redistribution prohibited

recommendation

Related Articles It’s great to read it with the article you just saw!

Vivid

Headline news Meet the main news at this time.