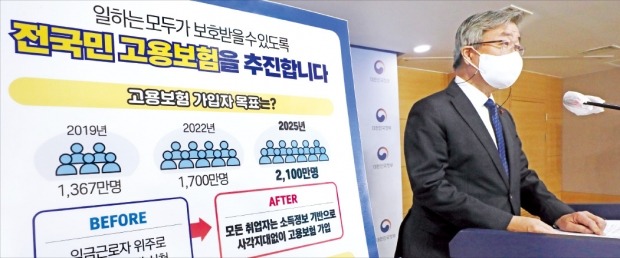

The government announced on the 23rd the’National Employment Insurance Roadmap’, which plans to increase employment insurance subscribers by more than 7 million by 2025. Minister of Employment and Labor Lee Jae-gap is giving a briefing at the Seoul Government Complex on the same day. /News1 “/>

The government announced on the 23rd the’National Employment Insurance Roadmap’, which plans to increase employment insurance subscribers by more than 7 million by 2025. Minister of Employment and Labor Lee Jae-gap is giving a briefing at the Seoul Government Complex on the same day. /News1 “/>

The government announced on the 23rd the’National Employment Insurance Roadmap’, which plans to increase employment insurance subscribers by more than 7 million by 2025. Minister of Employment and Labor Lee Jae-gap is giving a briefing at the Seoul Government Complex on the same day. /News 1

As the government promised to announce it within this year, a roadmap for applying national employment insurance was laid out on the 23rd. The goal is to increase the number of subscribers to 21 million by 2025 by enrolling more than 7 million people, including self-employed people, in employment insurance. It also decided to convert the wage-based insurance system to income-based. However, some are assessing that there is a lack of concrete action plans, such as financial security measures, tied to the promise of’announcement within the year’ without sufficient discussion between relevant ministries.

Target of Completion of National Employment Insurance by 2025

The roadmap aims to complete the nationwide employment insurance system by 2025 by expanding the targets of the current wage workers-centered employment insurance coverage to artists, specially employed workers, platform workers, and self-employed people.

Artists entered into force on the 10th. The target audience is about 75,000. Employment insurance coverage for special high school workers will take effect next July. The government’s policy is to give priority to 14 occupations that are currently covered by industrial accident insurance among special high school workers. This is because it is relatively easy to apply employment insurance, such as imposing insurance premiums, because it has higher exclusive properties than other occupations. The 14 special high school occupations subject to industrial accident insurance are insurance planners, learning branch teachers, golf course caddy delivery drivers, deputy drivers, door-to-door salespeople, and so on. The number of workers in these 14 occupations ranges from 1.06 million to 1.33 million. The government plans to impose insurance premiums for them by receiving monthly income payment statements submitted by employers on a semi-annual basis or sharing tax invoices with the National Tax Service.

From January 2022, digital platform workers such as delivery, translation, and housekeeping services will also subscribe to employment insurance. The government considers up to 1.79 million people to subscribe to employment insurance, including workers directly assigned to work on the platform and workers through the platform. The goal is to sign up for other special advisors and platform workers from July 2022.

The’last button’ of the nationwide employment insurance system is the self-employed with 4 million people. The government’s plan is to provide unemployment benefits even if the chicken house is closed after 2025. However, he could not come up with a concrete plan. Minister of Employment and Labor Lee Jae-gap said, “We still allow voluntary subscription to self-employed persons employing less than 50 employees, but the subscription rate is less than 1%.” In the first half of the year, we will form a social dialogue organization and start discussions.”

“It’s good, but you have to be on the lookout for the’grey rhino’”

Along with the expansion of employment insurance subscribers, the government predicted a fundamental change in the employment insurance system. First of all, starting by changing the eligibility for employment insurance for wage workers, which is based on working hours (60 hours or more per month) in 2022, to an income standard, the employment insurance plan will be reorganized into an individual management system like health insurance and national pension in 2025.

For example, a person who works as a full-time worker at a company on weekdays, works part-time at a convenience store for 5 hours on Saturdays and Sundays, and sometimes works as a substitute driver through the platform now subscribes to employment insurance based on the wages received by the company. Only possible. However, if employment insurance is converted to income-based, insurance premiums are set for all income and unemployment benefits are received accordingly.

The problem is that the establishment of an income monitoring system is slow. The employment insurance for special high school workers will be implemented in July next year, but the government expects that the completion of the real-time income detection system for them will be possible only in July 2022.

Concerns about fiscal soundness remain. In relation to the employment insurance for special high school workers, the government has made a fiscal estimate that a surplus of 449.9 billion won is expected by 2025, but the premium income compared to the unemployment benefit expenditure will decrease significantly from 2022, resulting in a deficit of 17.6 billion won by 2025. If it remains, the deficit is expected to increase gradually from 2026. This is the reason why economic organizations, etc., require the account separation of wage workers and other subscribers.

Experts point out that we should be wary of the’gray rhino’ in relation to the promotion of the national employment insurance system without sufficient preparation. The gray rhino is a term referring to a danger that is likely to occur in the future and has great impact, but people overlook it. Jo Jun-mo, professor of economics at Sungkyunkwan University, said, “The purpose of expanding employment insurance is good, but there are issues such as timely income determination, collection of multiple workplaces, and equity with wage workers.” “We have to come up with safety measures.”

Reporter Baek Seung-hyun [email protected]