Input 2020.12.23 12:00

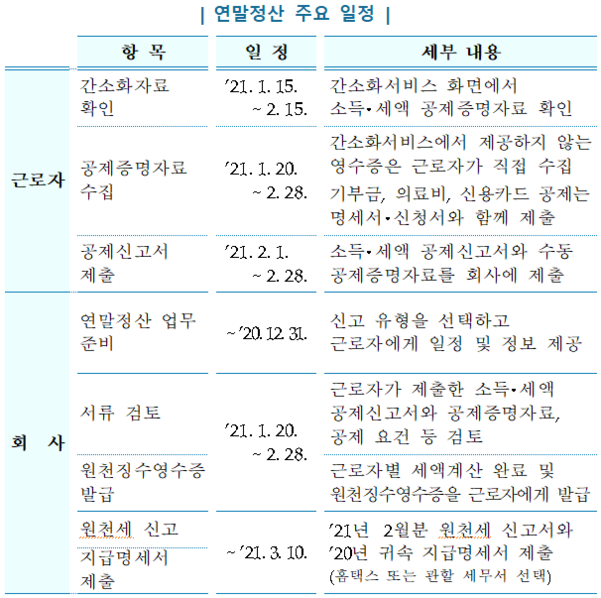

The National Tax Service announced on the 23rd that it will begin the year-end settlement of earned income this year. Workers are obliged to make year-end settlement until February of next year’s wages are paid. The year-end settlement simplified system that workers can see will be released on the 15th of next month.

In addition, the National Tax Service raised the tax-free limit on profits from stock option exercise of executives and employees belonging to venture companies from 20 million won to 30 million won per year in order to support the recruitment of excellent talent by venture companies. In order to support excellent Korean talents residing overseas, they can receive a 50% reduction in income tax for five years if they meet certain career requirements.

An official from the National Tax Service said, “In March-July this year, the income deduction rate for credit card usage has been greatly expanded, and the deduction limit has also been raised, so you need to be familiar with the contents of the revised tax law and prepare for year-end settlement.” “It would be useful to use proof of deduction (simplified data) and YouTube and chatbot counseling services.”

-How to do the year-end settlement if you change companies this year or if you are paid by multiple companies.

“At the end of December, the year-end settlement should be made by summing the earned income from the previous work place. In the case of income from multiple work sites, the year-end settlement is required by summing the income from the main work place. An income withholding receipt and a copy of the earned income withholding department for each income earner must be issued and submitted to the withholding officer at the current workplace.”

-How can I receive additional deductions if there are items that did not receive income and tax credits at the time of year-end settlement?

“You can receive additional income and tax credits through a final report on the tax base of comprehensive income or through a request for correction. For the omission of the income and tax credits of a worker, the employee himself/herself determines the comprehensive income tax base with the head of the competent tax office in May of the following year. All you have to do is reflect the missing income and tax credits while filing.”

-The annual income amount requirement for dependents to receive personal deductions.

“In order for dependents including spouses to be eligible for the basic deduction at the time of year-end settlement, the total annual income of the dependent family must meet the requirement of 1 million won (those with earned income, 5 million won total wages).”

-Is it possible to receive basic deductions for parents (including father-in-law and mother-in-law) living in the countryside?

“For housing reasons, if you live separately but are actually supporting them, and other siblings do not receive basic deductions from their parents and meet the income requirements (income amount of less than 1 million won) and age requirements (over 60 years old), the basic deduction is I can receive it.”

-Can a spouse who is married, divorced, or died during the year receive basic deductions for that year?

“If married during the tax year (excluding true marriage), it is a spouse as of the end of the taxable period, so if the sum of the spouse’s annual income is less than 1 million won, it is eligible for basic deduction, but the basic deduction for spouses divorced during the tax year If the spouse dies during the taxable period, the basic deduction can be applied.”

-Will all workers paying monthly rent receive a monthly tax credit?

“As of the end of the taxable period, a householder of a homeless household (including household members, if the householder has not received deductions for the repayment of principal and interest on housing leases, housing savings and long-term housing mortgage loans), and a worker whose total salary for the relevant taxable period is 70 million won or less If you rent a house (including residential officetel and Gosiwon) with a national housing size of less than or less than 300 million won, and the address of the lease contract and the address of the certified copy of resident registration card are the same, you can receive a monthly tax credit.”

-The requirements for the long-term mortgage loan interest repayment deduction.

“At the time of acquisition by the head of a household (including household members if the householder did not receive deductions for interest repayment of housing rental savings and long-term mortgage loans) as a resident with earned income (excluding daily workers) who owns no home or one house If a person who has acquired a house with a standard market price of 500 million won (300 million won before 2013, 400 million won in 2014 to 2018) meets certain requirements, the interest repayment paid in the relevant year on the borrowed funds will work within the limit. It can be deducted from the amount of income.”

-When paying with a credit card, etc., are there any items that can receive duplicate deductions other than income deductions such as credit cards?

“In the case of spending medical expenses, school expenses for preschool children, and school uniform purchases by credit card, etc., you can receive deductions for medical expenses, education expenses, and income deductions such as credit cards.”

-The company is receiving support for university tuition and is subject to tax exemption. Can I receive a tax credit for education expenses for this subsidy?

“You cannot receive tax credit for education expenses for non-taxable student expenses.”

-Those who are eligible for income tax reduction or exemption for employees of small and medium enterprises.

“As of the date of the conclusion of the labor contract, a maximum of 1.5 million won may be received when a young man aged 15 to 34 years or younger, a person 60 years of age or older, or a person with a disability or a woman with a career break is employed in a small and medium-sized company (women with a career break are re-employed in the same industry). .”

-If the employed company falls under Article 2 of the Basic Small and Medium Business Act only for small and medium-sized enterprises, whether the income tax reduction or exemption for employed small and medium enterprises can be applied

“Even if the employed small and medium-sized enterprises fall under the’Basic Act for Small and Medium Enterprises’, the reduction or exemption is applied only in the case of the enterprises specified in Article 27, Paragraph 3 of the Enforcement Decree of the Restriction of Special Taxation Act.”

-The child’s income and tax deduction data, which were searched last year, are not searched by the simplified service.

“The employee can inquire about income and tax deductions for children who have reached adulthood (over 19 years of age) only after the child has applied for consent to provide the data. If there are children who are scheduled to enlist in the military, the child must give consent before enlisting in the military. If you apply, you can make year-end settlement.”

-Is it possible to submit a simplified data or a deduction report to the company through mobile?

“From the year-end settlement attributable to 2019, you can submit the simplified data for year-end settlement or deduction report to the company on mobile. The company must register the basic data of the employee in the hometax (PC) convenient year-end settlement.”

-Can the mobile deduction report be revised or written, such as adding the deduction certificate data collected manually like a PC or deleting the simplified data?

“From the year-end settlement attributable in 2020, you can also modify and submit a deduction report via mobile, such as adding manual deduction certification data collected by workers in addition to the simplified data, or excluding the amount of simplified data that exceeded the limit.”

-What are the services provided by the convenient year-end settlement service?

“The worker can select the data to be deducted from the simplified service and automatically fill out the income/tax credit report. -If the company has registered the basic data for the year-end settlement of workers in advance, it can be submitted easily. Also, calculate the estimated tax amount for year-end settlement in advance and report 3 It can be compared with the annual trend. Dual-income workers can be guided on how to deduct their dependents to minimize their tax burden.”

-How to fill out the’Income and Tax Deduction Report’ that workers can automatically fill out in the home tax.

“In order to automatically fill out the deduction report, you must log in to the National Tax Service’s hometax and select the simplified data first. In the simplified service, select the data subject to deduction for yourself and your dependents, and click the’Complete Deduction Report’ menu to select a workplace and dependents. After going through the input (no single-person household) step, the deduction report is automatically filled out.”

-How much penalties will be borne if the payment statement is not submitted or is unclear on the income of religious persons attributable in 2020.

“If a religious organization pays income to a religious person, regardless of withholding and year-end settlement, it must submit a payment statement by March 10 of the following year. The payment statement is not submitted by the deadline or the submitted payment statement is If (business number, resident registration number, income type, payment amount, etc.) is written incorrectly, 1% of the payment amount will be charged as an additional tax.”